Case Study – Banking

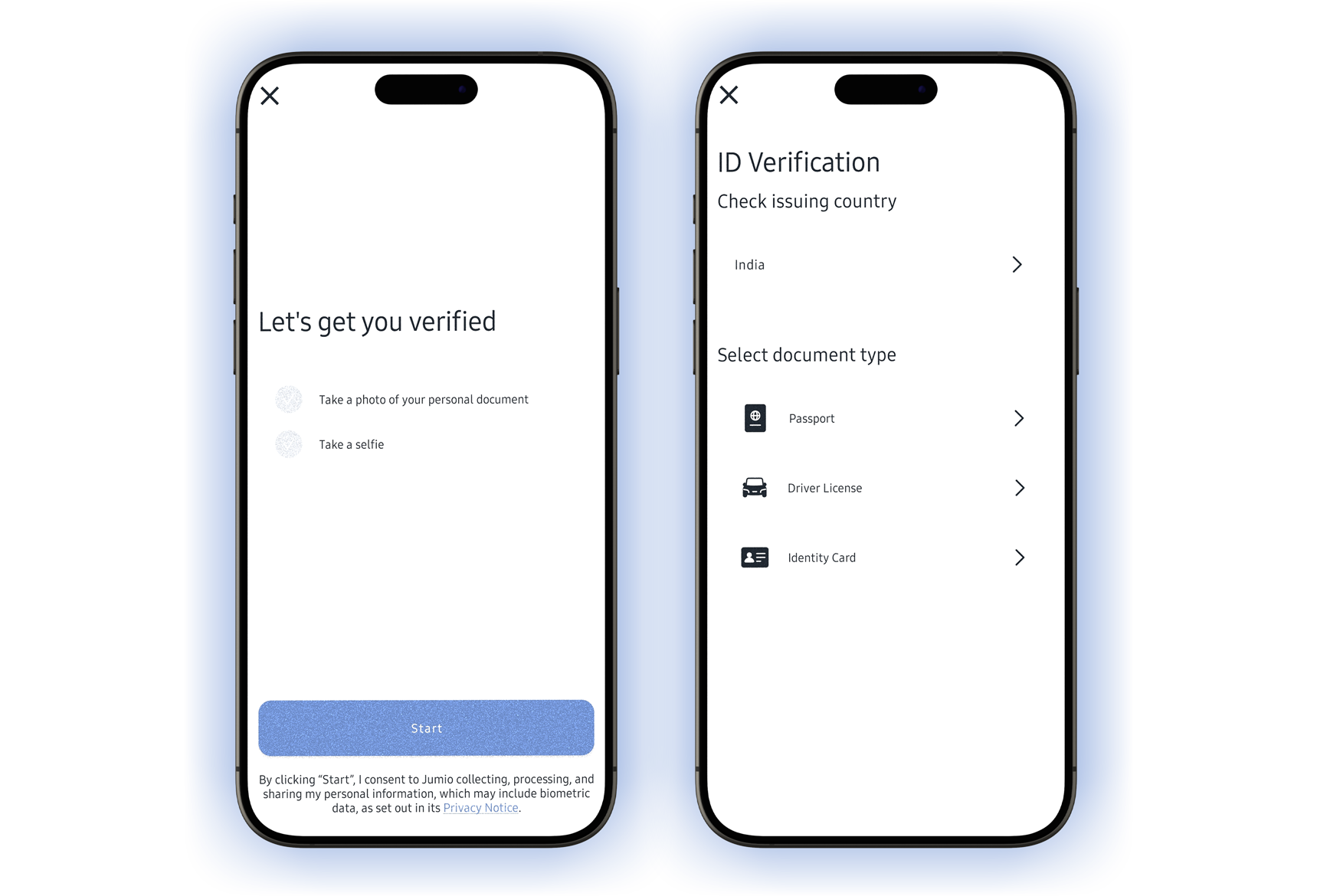

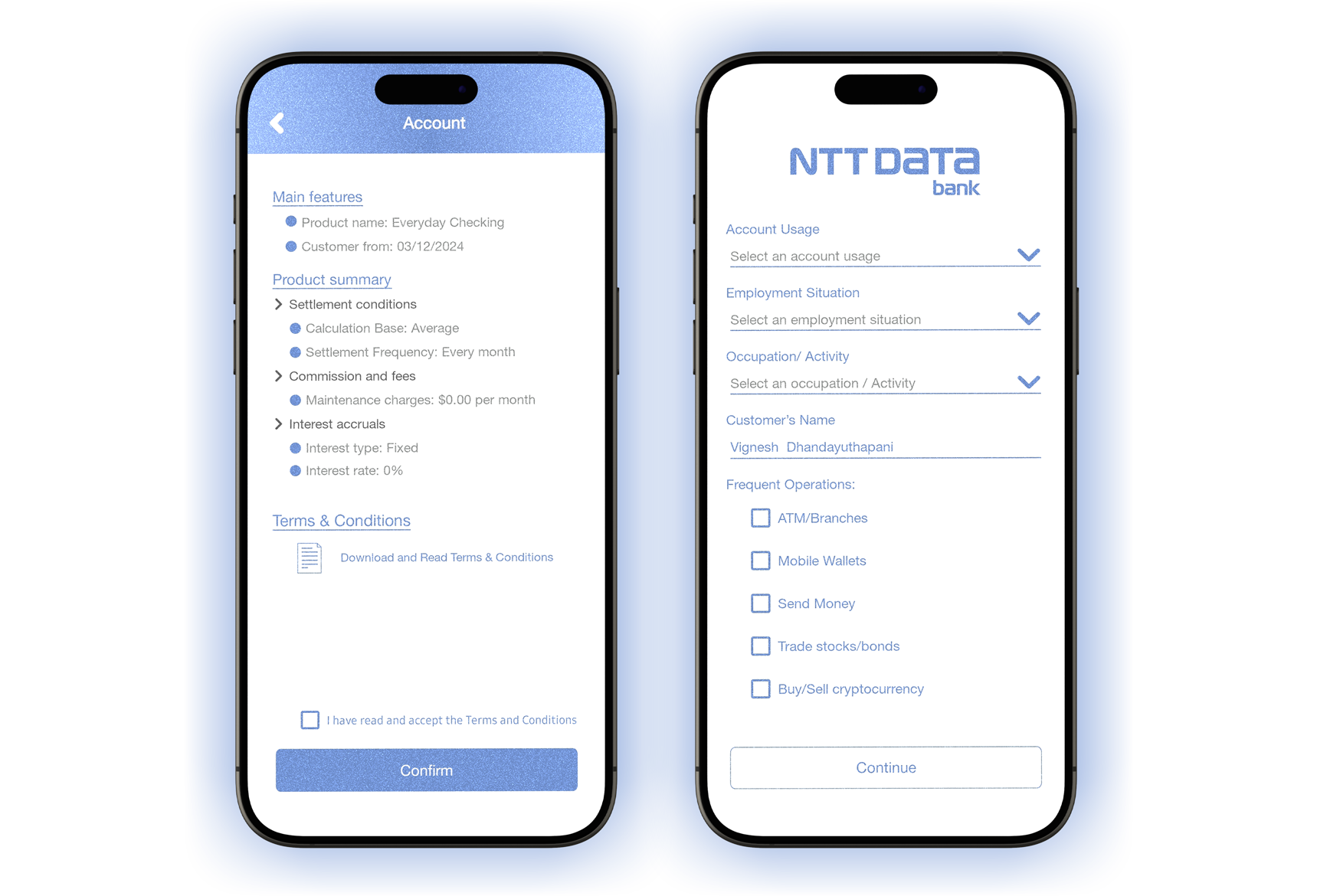

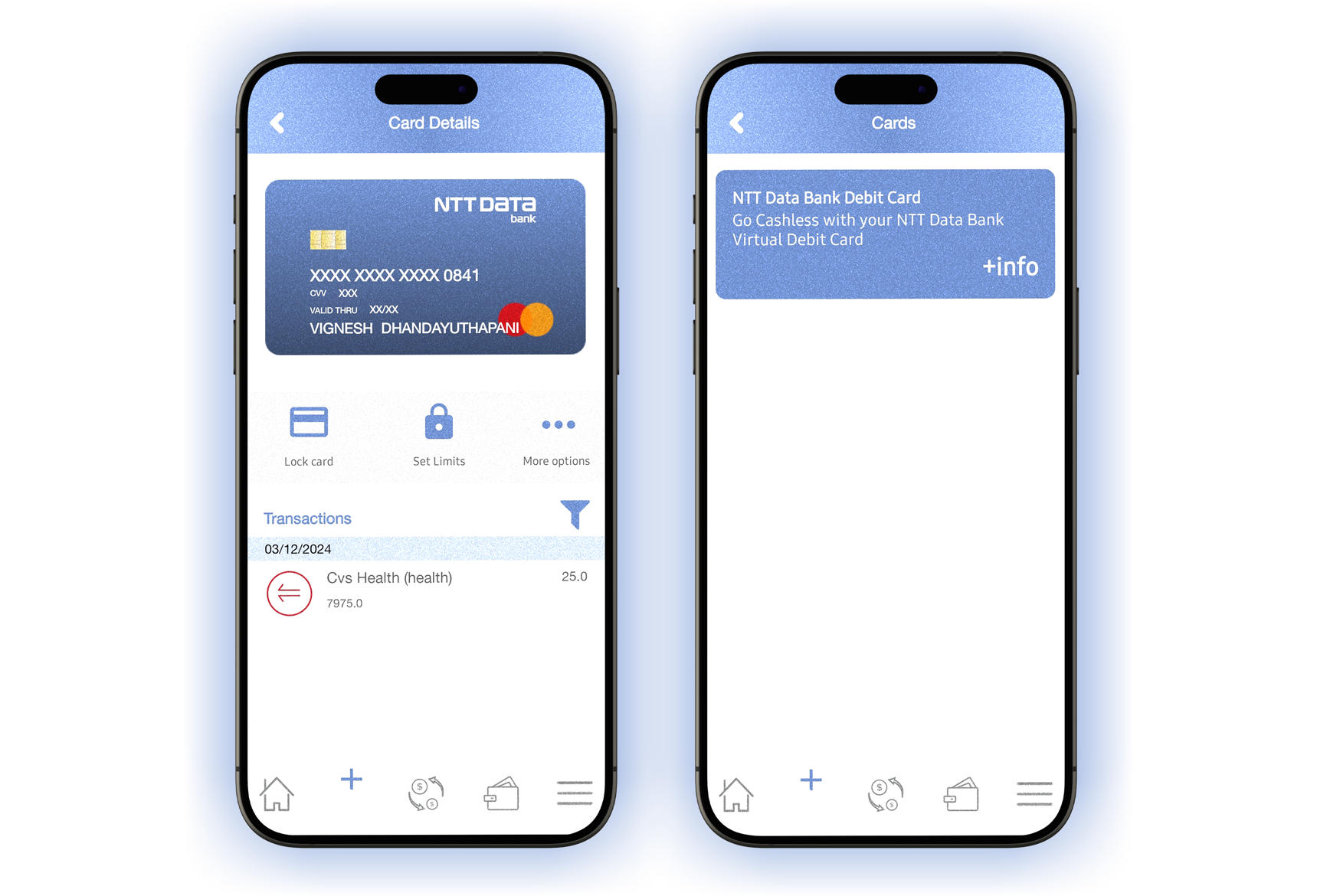

Case Study Tier 1 European Bank Facing the challenge of meeting digital-savvy customers’ demands in a competitive banking landscape, a Tier 1 European Bank collaborated with NTT DATA. Together, they developed a solution integrating payment initiation services into the bank’s infrastructure, transforming digital banking through web and mobile channels. Addressing the Challenge of Increasingly Digital…