Composable Banking

About Composable Banking

Composable banking is a modern approach to banking technology that leverages modular, flexible components to create adaptable financial services.

It allows banks and financial institutions to assemble, reassemble, and scale banking operations and customer offerings with unprecedented agility.

Imagine it as building with blocks, where each block represents a specific function or service, from loans processing to fraud detection, all designed to work seamlessly together or independently.

Modular solutions to accelerate implementation.

NTT DATA’s Composable Banking Solution

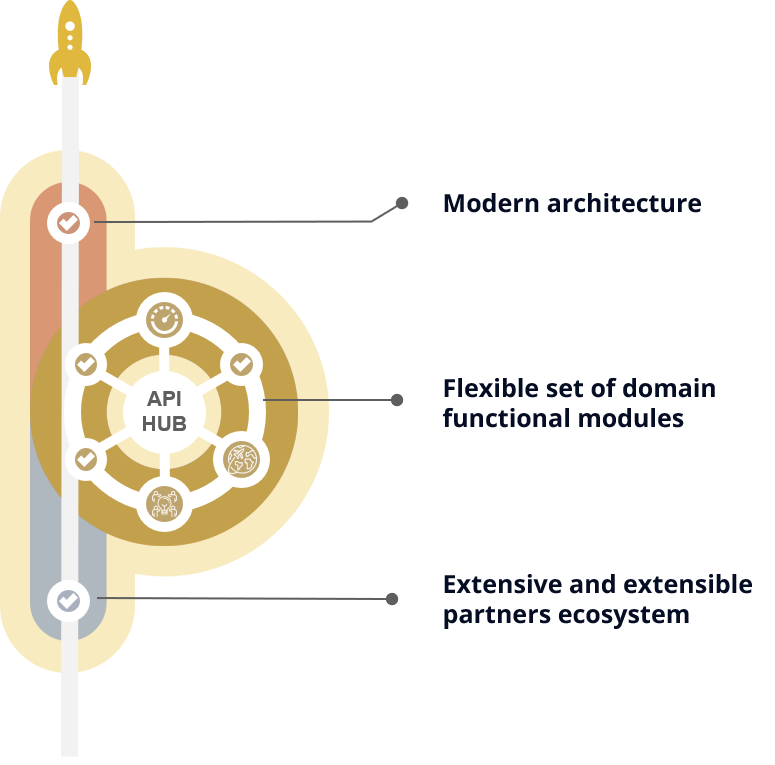

NTT DATA’s digital banking solution is built on a foundation of modern technology principles and practices that enable flexibility, scalability, and rapid innovation with the overarching goal of creating a dynamic, customer-centric banking ecosystem.

Microservices Architecture

At the heart of Platea banking, microservices architecture decomposes traditional banking applications into smaller, independent services. This modularity allows for rapid updates, resilience against system failures, and efficient resource use, as each microservice operates independently but communicates through well-defined APIs.

- Enhanced agility and flexibility

- Independent development and deployment

- Improved system resilience

- Efficient scaling and resource utilization

APIs and Integration

APIs facilitate seamless interactions among microservices and with third-party applications, enabling a unified banking solution. This interoperability supports customized banking experiences, fosters open banking ecosystems, and expedites the introduction of new features.

- Seamless service integration

- Customizable banking experiences

- Support for open banking initiatives

- Accelerated service development

Cloud Infrastructure

Cloud computing offers the infrastructure needed for scalable, reliable, and cost-effective banking. It allows banks to adjust resources dynamically, reduce capital expenditure, and innovate with the latest technologies, and leverage best of breed partner eco-system.

- Dynamic scalability and global reach

- Reduced infrastructure costs

- Access to cutting-edge technologies

Data Management and Analytics

Effective data management and analytics unlock personalized services and strategic insights. Analyzing customer data helps in tailoring financial products, managing risks more efficiently, and gaining operational insights, driving better decision-making.

- Personalized customer services

- Enhanced risk management

- Operational and strategic insights

Security

Security is integral, ensuring data protection and adherence to regulatory standards. Composable banking employs advanced security measures and continuous monitoring to protect against threats, alongside automated streamlining of regulatory processes.

- Robust data protection

- Comprehensive Identity and Access Management

- Real-time security monitoring

These foundational elements enable the construction of a dynamic, scalable banking ecosystem. By embracing these components, financial institutions can navigate the digital age with agility, offering tailored, efficient, and secure services.

A Modern Approach

Evolution of Banking Systems

The banking industry has evolved from traditional brick-and-mortar establishments to digital platforms, and now, to composable architectures. This evolution reflects the changing needs and expectations of customers, as well as advancements in technology. Composable banking stands at the pinnacle of this evolution, offering a way to quickly adapt to market demands and technological innovations without the need for complete overhauls of legacy systems.

Importance in Today’s Market

In a market where customer preferences shift rapidly and competition is fierce, the ability to innovate and adapt quickly is paramount. Composable banking meets this need by enabling financial institutions to launch new products, integrate emerging technologies, and respond to regulatory changes with speed and efficiency. It empowers banks to stay ahead in a competitive landscape and meet the ever-changing demands of their customers.

Benefits over legacy systems

Composable banking offers several advantages over traditional legacy systems, including:

Agility: Rapidly respond to market changes and customer needs by adding, updating, or removing services.

Scalability: Easily scale operations up or down based on demand, without the constraints of monolithic architectures.

Innovation: Foster innovation by making it easier to test new ideas and integrate cutting-edge technologies.

Cost Efficiency: Reduce operational costs by leveraging cloud-based services and partner capabilities

Customer Satisfaction: Enhance customer experiences by providing more personalized and responsive services.

Composable banking is not just a technological upgrade; it’s a strategic imperative for any financial institution aiming to thrive in the digital age. So if you are a bank seeking to innovate and stay competitive, looking for a flexible, scalable platform to launch and grow offerings, or a financial service provider aiming to enhance their customer experience and operational efficiency, you need to take to consider composable banking as table stakes for driving future flexibility and innovation.

Implementing Composable Banking

Transitioning to composable banking is a strategic journey that requires careful planning and execution. NTT DATA can help through the definition, design, and implementation process, ensuring a smooth transition and maximization of benefits.

Strategic Planning

A clear, strategic vision is essential for aligning composable banking initiatives with business goals. Organizations should:

- Define clear objectives and outcomes for the transition.

- Assess current systems and processes to identify areas for improvement.

- Develop a phased implementation plan to manage the transition effectively.

- Prioritize customer needs and experiences in the planning process.

Choosing the Right Technology Partners

Selecting technology partners that offer robust, scalable, and secure solutions is crucial. Look for partners with:

- A proven track record in composable banking solutions.

- Strong support and development resources.

- Alignment with the institution’s technology standards and requirements.

- The ability to provide strategic insights and guidance throughout the implementation process.

Cultural and Organizational Change

Adopting composable banking often requires a shift in organizational culture towards agility and innovation. Organizations should:

- Foster a culture of continuous learning and adaptability.

- Encourage collaboration across departments and teams.

- Invest in training and development to equip staff with the necessary skills.

- Promote a customer-centric approach in all aspects of the business.

Regulatory

Navigating the regulatory landscape is a relevant aspect of implementing composable banking. Ensure compliance by:

- Keeping abreast of relevant financial regulations and standards.

- Integrating compliance considerations into the design and deployment of new services.

- Leveraging technology to automate and streamline compliance processes.

- Engaging with regulators to clarify requirements and demonstrate compliance.

Monitoring and Continuous Improvement

Ongoing evaluation and refinement of composable banking systems and services are essential for achieving long-term success. Implement mechanisms for:

- Continuous monitoring of system performance and customer feedback.

- Regularly reviewing and updating services to ensure they meet customer needs.

- Identifying and addressing emerging challenges and opportunities.

- Fostering an environment of innovation and continuous improvement.

By following the above guidelines, organizations will realise the potential from enhanced agility, innovation, and customer satisfaction in an ever-evolving digital landscape.

Speak To Us About Platea’s Composable Approach

Composable banking not only addresses the immediate challenges of agility, efficiency, and customer satisfaction but also sets the stage for sustained innovation and competitiveness in a rapidly evolving digital landscape. Organizations that embrace this approach can expect to thrive in the digital era.

To organizations ready to embark on this transformative journey, we extend an invitation to discuss more. Our team is equipped to guide you through the nuances of adopting composable banking, from strategic planning to technology selection and implementation.

The future of banking technology lies in adopting composable architectures. Composability not only aligns with the principles of open banking but also offers a robust framework for modernizing legacy systems. Platea was designed from the grounds up with composability front and center.